Home Buying Process Made Easy

Kevin Singh Gill

Guiding You Along the Way

“Client for Life Philosophy” I am personally committed to going above and beyond in all the services that I will provide you. Our team is dedicated to giving you excellent service from initial consultation to moving day & beyond. We want our relationship with you to be long-lasting and transparent from day one.

Let us show you...

WHAT, WHY, WHEN, & HOW

Buy with Confidence

Clear Advice. Strategic Guidance. Client-First Representation.

Buying a home is one of the most important financial decisions you’ll make. When you work with Kevin Singh Gill, you receive informed guidance, strong negotiation support, and a structured buying process designed to help you make confident, well-timed decisions—without pressure.

Whether you’re a first-time buyer, upgrading, or investing, the goal is the same: protect your interests while navigating today’s competitive real estate market.

Our Buyer-Focused Approach

1. Understanding Your Goals

We start by understanding your needs, budget, timeline, and long-term plans. This ensures your search stays focused and efficient, saving you time and avoiding unnecessary stress.

2. Market Knowledge & Property Selection

You receive access to:

MLS® listings and off-market opportunities where available

Neighbourhood insights, pricing trends, and recent comparable sales

Honest feedback on value, resale potential, and market conditions

Properties are evaluated based on facts, not hype.

3. Offer Strategy & Negotiation

When you’re ready to make an offer, we provide clear advice on:

Pricing strategy and market value

Subject conditions and risk management

Deposit structure and completion timelines

Negotiations are handled strategically to help you compete effectively while protecting your interests.

4. Due Diligence & Subject Removal

We guide you through key due diligence steps, including:

Home inspections

Financing and appraisal timelines

Strata document reviews (where applicable)

Professional referrals when needed

Our role is to help you understand your options so you can make informed decisions.

5. Transaction Management to Completion

From accepted offer to possession day, we coordinate with lenders, lawyers, inspectors, and the seller’s side to help ensure a smooth and well-managed transaction.

Buyer Peace-of-Mind Commitment

Buyer Protection Plan – Commission Commitment

If you purchase a property through Kevin Singh Gill and decide to sell within 12 months of completion due to dissatisfaction, we will provide listing services without charging a listing commission, subject to written terms and conditions.

This is not a guarantee of satisfaction, market value, or sale, and relates solely to commission entitlement.

How much my services cost to the buyer?

ZERO, the buyer’s agent commission is paid by the seller after the real estate transaction closes. In British Columbia, both buying and selling realtors are paid through the seller’s commission. The funds are transferred to the selling agent’s broker, who splits the fees between the buying and selling agents.

FIRST TIME HOME BUYERS

The steps to buying your home might seem complicated at first—particularly if you’re a home buyer dipping a toe into real estate for the very first time. Between down payments, credit scores, mortgage rates (both fixed-rate and adjustable-rate), property taxes, interest rates, and closing the deal, it’s easy to feel overwhelmed. There’s so much at stake with a first home!Still, if you familiarize yourself with what it takes to buy your first home beforehand, it can help you navigate the real estate market with ease.

So let’s get started!

Step 1:Planning ahead:Owning a home is a big decision and getting off to a good start can make all the difference.

Step 2:Start gathering a down paymentThe very first step every first-time home buyer should tackle is to figure out their finances. Buying a new home (particularly for the first time) requires a mortgage, where a lender fronts you the money and you pay it back over time. However, in order to get a mortgage, you’ll need some sort of down payment. So how much do you need?Ideally a down payment on a mortgage should be 20% of the home’s price to avoid added fees, but if you don’t have that much of a down payment, don’t worry. A mortgage down payment can be as low as 10%, 5%, or even 0% for certain types of mortgages

Step 3:Check your credit scoreDid you forget to pay off a couple of credit cards? Unfortunately, it’ll affect your credit score.In addition to having a down payment, a first-time home buyer will need a decent credit score. This three-digit number is a numerical summary of your credit report, a detailed document outlining how well you’ve paid off past debts like for credit cards and college student loans.A lender will check your score and report in order to estimate the odds that you will deliver your monthly payment, too. In turn, the lender will use this info to decide whether or not to loan you money, as well as how much and at what interest rate. If a lender sees some late payments on your credit cards or other blemishes in your credit report, this can lower your odds of getting a loan with a great interest rate, or perhaps even jeopardize your chances of getting any loan at all.So it’s essential to know your credit score, and take steps with those overextended credit cards and high-interest debts to bring your credit score up to snuff.

Step 4: Review your spending.You need to know exactly how much your spending every month-and where it’s going. This calculation will tell you how much you can allocate to a mortgage payment. Make sure you account for everything-utilities, food, car maintenance and payments, student debt, clothing, kid’s activities, entertainment, retirement savings, regular savings, and any miscellaneous items.

Step 5: Look at your savings.Don’t even consider buying a home before you have any emergency savings account with three to six months of living expenses. When you buy a home, there will be considerable upfront costs including the down payment and closing costs. You need money put away not only for those costs but also for your emergency fund. Lenders will require it.

Step 6: Find a real estate agent.Want a trusty home-buying guide by your side. Most first -timers will want a great real estate agent-specifically buyer’s agent, who will help them find the right houses, negotiate a great deal and explain all the nuances of home buying along the way. The best part is that the buyer’s agent services are free to first-time home buyers because the seller pays the sales commission. To find to more, register with us for one-on-one Buyer Consultation.

HOME BUYING STEPS

Step 1: Buyer Consultation

First Step is to schedule one-on-one Buyer’s Consultation with us to thoroughly understand and define the reasons why you want to purchase a new home. To Stop paying rent?, To Start building equity?, To have a place to your own?, To raise a family?, To move up to a bigger house?We will develop a needs vs. wants list for you. Everyone has a picture of their ideal home. This home would include all the features you not only need, but have long desired. However, when it comes time to buying a home, these desired features constitute additional costs. While it’s nice to think about having an artfully landscaped backyard, or built-in appliances, these are usually considered luxury items, which can add considerably to the price of your property. Begin the list with items you absolutely need like adequate room, garage space and number of bedrooms. How much space do you really need? Does your situation require a one-level home, or are stairs acceptable? Basic needs should be considered first. After these have been established, you can consider additional features if you can manage these benefits financially. With such a list in your hands, you’re less likely to be caught up in the excitement of the pursuit. You’ll have a good idea of what you want, the features within your price range, and whether or not you can afford those additional items. Think of yourself as zeroing in on a target, going from the general to the specific.Consider area (North Delta, North Surrey, Surrey, Cloverdale, Langley); neighbourhood (older and settled or brand new). Check out the neighbourhoods you’re considering, and ask around. What amenities does the area have to offer? Are there schools, churches, parks, or grocery stores within reach? Consider visiting schools in the area if you have children. How will you be affected by a new commute to work? Are there infrastructure projects in development? All of these factors will influence the way you experience your new home, so ensure you’re well-acquainted with the surrounding area before purchasing.

Step 2: Pre-Approval

Once you’ve narrowed down your list, you’re ready to take the next step in the purchasing process: getting pre-approved with a mortgage company. While getting pre-approved may sound daunting, it actually just involves getting an idea of what you can afford. When you’re pre-approved, this means that a lender has reviewed your credit history, verified your assets and employment, and has approved your loan before you’ve found a home to purchase. Pre-approval gives you substantial leverage: sellers immediately see you as a serious buyer. Not only will you know the exact price range you can afford, but you’ll also be able to negotiate a better deal and move more quickly when you see a house you like. Depending upon market conditions, a seller may lean towards an unconditional offer, so you’ll have less negotiating power if you have to wait for mortgage approval. Banks and financial institutions have developed many programs catered specifically to home buyers. Once you review your needs and objectives with a lending officer, you’ll be one step closer to purchasing your home.Contact us and We’ll be happy to refer you to a mortgage professional with an excellent reputation and track record for successfully acquiring loan approval for his/her clients.

Step 3: Home Search

It is a very time consuming process to view every home available that meets your needs. We can do much of the work for you, by establishing your needs, then reviewing a range of properties and advising you of potential matches. We have our fingers on the pulse of housing trends and prices and access to the best possible resources and communication systems available today to help you locate homes on the real estate market that match your specifications. A comprehensive knowledge of the available homes in your neighborhood is one of our strongest assets and will be a major factor in allowing us to negotiate a reasonable price for the home you want. Once you’ve been pre-approved and know what price range you plan to stay within, we can help you determine which properties fit your needs and wants, using the (MLS) Multiple Listing Service system.As an experienced realtors we are privy to any new homes coming onto the market, which ensures you get access to these homes before the general public.

Step 4: The Offer

We will prepare your Written Contact of Purchase and Sale and present your offer to seller/ Seller’s Agent. We will help you decide on key terms and conditions as well on on key element of our offer, like price, deposit, subjects, clauses, terms, conditions, subject removal dates, completion dates, possession date, adjustment dates, inclusions and exclusionsetc.Market Evaluation: We will prepare CMA for you so that you can buy your investment based on fact. When you buy with us, you buy with confidence.

Step 5: Negotiations

Your offer may be accepted at that time, but more likely the sellers will respond with a counter offer. There may be a change in the price, dates or subjects; whatever the case may be, we will discuss the options with you and work diligently on your behalf to negotiate with the sellers and their agent. We will endeavour, to the best of our ability, to get your offer accepted but sometimes regardless of how hard we try, an agreement cannot be reached. It can be very discouraging and frustrating when this happens, but we will be with you every step of the way and continue to make it our goal to find your new home!

Step6: Due Diligence

Hooray! Your offer has been accepted but is not a “firm offer” until all subjects are removed. We will discuss this process in detail with you as each offer is unique, but there are a few things that need to happen right away:Let your bank/mortgage broker know you have an accepted offer on a home. They will want a copy of the Contract of Purchase & Sale (we will provide you with one).We will obtain & review with you any necessary documents such as Title Search, Site Survey, Strata Documents,Form B, Strata Minutes, Bylaws, Financial Statements, Engineers reports, Registered Strata Plans, Depreciation report, Property Condition Disclosure Statement (as per your offer).Depending on the subjects that were part of your offer, you may need to schedule an inspection. Your bank or mortgage broker may require an appraisal as well as fire insurance. We will assist you with this.In order for an offer to become firm, all subjects must be removed by the date specified on the Contract of Purchase and Sale. We will guide you through the process and ensure it goes smoothly!

Step 7 : Subject Removal & Deposit

Subject removal is a period of time in which the buyer works to satisfy the conditions, also known as subjects, that are listed on the accepted offer for a particular property. Subject removal works as a great safety net for buyers as it allows the buyer to perform their due diligence related to the subjects that were accepted, such as reviewing strata documents or the title search for the property. If the buyer is satisfied and approves all subjects listed, then they would proceed to “remove subjects” and hand in the deposit so that the deal can now become firm. These subjects are listed in the terms and conditions section of the contract of purchase and sale and must be agreed to by both the seller and the buyer.The deposit will be due either upon subject removal or within 24 hours after you have removed subjects. In the Fraser Valley , the deposit is usually 5% of the purchase price and will be held in trust by the buyer’s agent’s brokerage. This deposit will then form a part of your down payment.

Step 8: Prep for Closing

Getting all the paperwork to all the peopleMortgage Broker: We will handle getting the necessary paperwork over to your mortgage broker.Lawyer-You will need to choose a lawyer or notary that handles Real Estate transactions. There are numerous law offices that provide these services so you may want to shop around, however it is important to select a lawyer as soon as possible. If you are unsure of who to use, just ask us! We will be happy to provide you with some options. We will also handle getting the necessary paperwork over to the office you select.Get you in contact with tradesmen: If there are any repairs or updates that you want before moving into your new home.Get in contact with Moving Companies: Start packing and arrange a moving truck and cleaners (if needed) as soon as possible, especially if your possession date is at the end/beginning of the month. This is also the time to start setting up and arranging your utility accounts (phone, Internet, cable, hydro, gas etc)

Step 9: Completion

Your lawyer/notary will contact you to arrange a time for you to sign all of your paperwork, usually on or just before your Completion date. They will answer any questions you may have and advise what you will need to bring to your appointment.

Step 10: Welcome to your New Home Possession & Adjustments

The best part is here – time to move! This is our favourite part too and we wouldn’t miss it for the world! We will arrange to get the keys and meet you at your new home on possession day.

TYPICAL CLOSING COSTS

BUYING A HOME? REMEMBER THE CLOSING COSTS!

The down payment is the main cost on the forefront of our deliberations and financial planning. Many buyers get caught off guard when they realize that there are additional Costs that can easily amount to another 1-4% of the purchase price of the house. Well, working with us, you don’t to worry about anything. You won’t be caught off-guard like many other buyers. Closing costs on a house should be part of your planning early on.

SO WHAT ARE CLOSING COSTS?

Closing costs are additional expenses incurred when buying a home. These costs can add up to anywhere from 1.5% to 4% of the purchase price of the property.Some of the closing costs to prepare for include:

1. Home Inspection Fees

While not mandatory, having a professional home inspection done is smart, especially if you are a first-time buyer. The home inspector will inspect the condition of the house with respect to structure, plumbing, ventilation, heating, etc. A full home inspection will cost you approximately $500 on average plus GST/HST.

2. Property Appraisal/Valuation Fees

Your mortgage lender may require you to obtain a professional appraisal of the property to determine its worth. A property appraisal may cost anywhere from $250 to $500. Some lenders choose to pay the appraisal fee.Insured mortgages generally don’t require an appraisal since the insurer auto-values the property, which saves you a little money.

3. Property Survey Fee

A survey shows the boundaries of the land and indicates the location of major structures and any encroachments on the property. A mortgage lender may require that you provide a survey or you may just want one for keeps to ease your mind, especially if newer structures or additions have been added to the house. A survey costs between $1000 and $2000.

4. Title Insurance

Title insurance covers potential issues that may arise after the purchase from title defects, survey errors, existing liens on the property, encroachment issues, zoning issues, etc. Title insurance will set you back $300 or more.

5. Land Transfer Tax (LTT)

The property transfer tax on the purchase of all real property in B.C. It is calculated based in 1% of the purchase price upto $200,000 and 2% on any amount above $200,000 upto $2,000,000. As of 2016, the property transfer tax will be 3% on the portion of the price above $2,000,000. where GST is applicable to the purchase price, property transfer tax is not calculated on the GST portion. As a first time home buyer, you are eligible for full exemption of property transfer tax provided purchase price is $500,000 or less. With a purchase of $500,000 to 525,000 the property transfer tax is applied according to a sliding scale. These exemptions exist under the following conditions: You never owned a primary residence anywhere in the world, You are a Canadian citizen or permanent resident, and been in B.C for a minimum of 12 months prior to completion. You must reside in the home for a minimum of 1 year following completion. If 2 people purchased the home, but only is eligible for exemption. The Property tax payable will be based on the portion of ownership for the non-eligible person. Purchasing a newly built home with a purchase price of $750,000 or less will pay no property transfer tax. With a purchase of $750,000 to $800,000 the property transfer tax is applied according to a sliding scale. Purchase are not required to be 1st time Home Buyers, but must live in the home for 1 year after completion.Example: Property Purchase Price $500,000 ( 1% of the 1st $200,000=$2000, 2% of the balance $300,000=$6,000, Therefore, Total tax owing on completion $8,000).The Property Transfer Tax cannot be included in your mortgage. This must be paid upon completion.

6. Legal Fees

A lawyer is required to help you sort through the legal paperwork to ensure it is accurate and makes sense. Your lawyer will also likely carry out a title search and sort out the title insurance on your behalf. These costs may be billed separately or combined with the legal fees. Clarify this with your lawyer before you start. Legal fees vary, with basic fees starting at around $500. After incorporating other expenses including mailing, photocopying, etc expect your final bill to be approx $1000 to $1500 or more.

7. Adjustment Costs

A statement of adjustments is drawn up by your lawyer to ensure that prepaid costs like utility bills, property taxes, condo maintenance fees, and other bills are adjusted fairly. The seller gets a credit back if they have already paid some bills past the date when you take ownership of the property.

8. Home Insurance Premium

Mortgage lenders will ask for proof of a home insurance before they release funds on closing day. Home or property insurance covers the cost of replacing your home and its contents. It may be billed monthly or annually. The cost will vary depending on the value of your home, its contents, location, type of coverage, your deductible, presence/absence of an alarm system, etc.

9. PST/HST on Mortgage Default Insurance

If you put down less than 20% of the purchase price as down payment, your mortgage is considered a high-ratio mortgage and requires that you buy a mortgage loan insurance. The premium can be financed through the mortgage, however, where applicable, the Provincial Sales Tax/Harmonized Sales Tax on this insurance must be paid up front.

10. Tax on New Homes

If you are buying a brand new house, you may be subject to both federal and provincial taxes. The tax is often incorporated into the sale price, but it’s better to confirm before proceeding. You may qualify for a partial rebate on taxes when filing your income tax return, but you will need to pay it up front when buying the house.

11. Property Taxes

While this is an ongoing annual cost, you may be required to pay back a significant amount to the owner in adjustment costs if they have already paid the full taxes for the year in advance. Property taxes are required on a house you own. The tax is levied on an annual basis by municipality where your house is located and must be paid either monthly or annually. The amount of property tax differs based on the assessed value ofyour home.

12. Estoppel Certificate Fee

This fee is applicable if you are buying a condominium. Also known as status certificate, the estoppel certificate is a document detailing important information relating to the specific condo unit and the condominium corporation. The information includes bylaws, rules and regulations, insurance information, property management and ownership, financial statements, etc. This fee may cost up-to $100 or more.

13. Interest Adjustment

This is the interest you will pay for receiving mortgage money before the official start of your mortgage (i.e. if your “completion” were on the 23rd of a 30 day month, your interest adjustment would be 8 days interest).

14. Insurance Binder

This is a requirement by the bank to ensure that the purchase has arranged fire insurance on the new home. Proof of coverage by way of an insurance binder is necessary and usually cost about $35.00 ( This is not applicable for a Strata Property)

15. Property Tax Adjustment

Generally property taxes for the calendar year are paid at the beginning of July. If you purchased a property before July 1st, the seller will be paying you for the days they owned the home after January 1st. If you purchase after July 1st, you will pay the seller for the days you own the property before December 31st ( one Day’s taxes on owner occupied properties area-annual taxes divided by 365).

16. Strata Cost Adjustments and Form A Certificate

For Strata Properties only, the adjustment works similar to the property tax adjustment previously explained. The difference is that Strata fees are paid monthly not annually, therefore the adjustment will be based on the number of days in your completion month. A form A-certificate is required only when a Strata Property is purchased. The certificate is issued in order to confirm that the previous owner does not owe the Strata Corporation any money. This Certificate will range in price upto approximately $50.

17. CMHC Application Fee

This is a approx. $75 underwriting fee paid to CMHC ( Canada Mortgage and Housing Corporation) for processing a hi-ratio mortgage application and initiating the mortgage loan insurance. This fee is usually deducted from the mortgage proceeds. The downpayment required to purchase a home is the current market is a minimum of 5% of the purchase price. Any amount of down payment less than 20% will require approval from CMHC or Genworth to be insured. Insuring a mortgage will cost you an insurance premium which will be added to your mortgage. If you have a down payment of 20% or more, this is considered conventional financing and only require lender’s approval. Conventional mortgages do not need to have the mortgage insurance.

13. Other Costs

There are many other direct and indirect costs of buying a house. They include moving costs, new appliances, decorations and new furnishings, renovations, repairs, utility hookup fees, hand tools, vent cleaning, house cleaning, and many more. These costs may range anywhere from a few hundred dollars to several thousand dollars. You should plan for them in your budget.From the list above, you can see why it is not a good idea to forget about how much funds you really need to have at hand when buying a house. If you were initially planning on saving down 5% of a $350,000 mortgage i.e. $17,500, adding on a further 1.5-4% now puts your savings goal at $22,750 to $31,500.

BUYER FAQ'S

What Home can I afford?

That depends, of course—on your income and other financial obligations; And do it before you start shopping – if you see houses you love outside your price range, it opens you up to disappointment. Meet with a lender to get pre-approved for a home loan (added bonus: pre-approval makes you much more attractive to sellers).

What’s the first Step of he home buying process?

The Mortgage Pre-Approval. – Unless you are paying cash for a house, you will need to get a mortgage. In order to know how much home you can afford, you will need to get pre-approved for a loan. This is the first-step in the home buying process.

Can I check my credit rating before I apply for a mortgage?

Everyone’s credit rating is based on a combined score that is generated from three credit bureaus that look at your credit history, amount of credit available, and the recent inquiries that determine what is called your FICO score. For a small fee, you can get your score or review your credit report by going online to www.myfico.com or by contacting the credit bureaus directly at:

EQUIFAX www.equifax.com

EXPERIAN www.experian.com or (888) 397-3742

TRANSUNION www.transunion.com or (800) 916-8800

What Kind of Credit Score do I need to buy a home?

A 620 credit score, or higher, is recommended. As you are probably aware, a higher credit score offers better lending terms. This is an ever evolving topic, however, as loan requirements are constantly changing. There are some lenders who will approve buyers with a 580 score, sometimes even lower. Your loan officer will be the best source to give you a current answer for today’s lending requirements.

How are Pre-qualifying and pre-approval different?

Pre Qualified: the initial step in the mortgage progress, a lender or bank will calculate the general mortgage amount you qualify for. This is done by evaluating your debt, income and assets.

Pre Approval :This comes after pre-qualification. You will make an official application for a mortgage and the lender will perform an extensive check of your financial background and current credit rating. After which the lender will tell you the amount you have been approved for.

The main benefits of obtaining pre-qualified and pre-approval are 1) knowing exactly how much you can spend on a home so you do not waste your time looking at homes beyond your means. 2) This makes you more appealing to a seller as you are closer to having an actual mortgage.

How do I choose a lender?

When you are ready to shop for a loan you have two basic types of mortgage stores to shop — direct lenders and mortgage brokers. Direct lenders, like your bank, have money to lend. They make the final decision on your application. Brokers are intermediaries who have many lenders from which to choose. Direct lenders have a limited number of in-house loans available. Brokers can shop many lenders for each lenders’ store of loans. If you have special financing needs and can’t find a lender to suit them, an experienced broker may be able to ferret out the loan you need. On another note, some home buyers fail to stay up with the requirements of the lender as the home progresses to closing and then find themselves way behind in the process at the very last minute. Sometimes this can lead to delay or even cancellation of the house closing and frequently can happen when a buyer uses an internet lender. We can help you take care of your end of the deal by staying on the same page as the lender all the way through the process. And remember to choose a lender that you are confident will be able to be reached easily by phone when questions or problems need to be addressed immediately.

How much money do I need for a downpayment ?

It depends on your loan type. Usually 3% to 5% down – The most common answer is 3% to 5% of the purchase price. FHA loans just dropped their requirement from 3.5% to 3.0%. There are also some conventional loans that only require 3% down. Veterans are usually eligible for a VA loan, which requires no money down. Properties in rural areas are usually eligible for a USDA loan, which also requires no money down.

What other Fee are there, besides the downpayment?

Mainly loan origination and closing costs. – The downpayment is usually the largest cost associated with buying a house. Lending fees are the second largest costs to homebuyers. Most lenders will charge between 2% to 4% of the loan amount for loan origination fees, depending on the loan type. Conventional loans usually have lower loan origination fees, but require more money down. Your loan officer will be able to help you determine how much you can expect to pay towards loan origination and closing costs.

For a detailed list of all potential home buying fees, see our article entitled “How To Avoid Sticker Shock at the Closing Table?”

Do I really need a realtor when buying a home?

When buying a home, it’s strongly recommended you have a Realtor. There are many reasons why you should have a Realtor represent your best interests when buying a home. Keep in mind, all Realtors are not the same! When choosing a buyer’s agent, make sure you know how to interview prospective Realtors when buying a home.

Attempting to buy a home without a Realtor can really make the home buying process more difficult. Having a Realtor is always recommended when buying a home. One thing not to do when buying a home is calling the listing agent because you don’t want to “bother” your Realtor. This is one thing that real estate agents hate.

Who pays the realtor fees when buying a home?

One reason why buyers ask the question about the need of having a Realtor when buying a home is because they don’t understand who pays the Realtor fees when buying a home. There are no guarantees, however, in most cases the seller pays the Realtor fees.

Should I buy or continue to rent?

Buying a home can be a very solid investment. This being said, renting can also be a better option for some, depending on the circumstances. The current interest rates are incredible. A 30-year FHA mortgage can be locked in at a rate of around 3.5%. Since the interest rates are so low, it actually can be cheaper to pay a mortgage right now than paying rent.

There are questions that you should ask yourself before deciding to buy a home. One of the most important things to consider is the length you plan on staying in a home, if you were to purchase. If the answer is only a few years, it’s likely the better decision is to continue renting. Another question to ask yourself is whether you are ready to take on the additional “responsibilities” of owning a home.

When owning a home there will be general home maintenance that should be done, are you ready for that?

Buying a home is a great option in many cases, but not always.

Can I find a rent-to-own property?

Can you find a needle in a haystack? Of course you can, but the probability isn’t very high. The same can be said about a rent-to-own property. A common question from home buyers is whether rent-to-owns exist or whether an owner would consider that option. They are out there, but there are somethings that you need to know before agreeing to a rent-to-own.

When an owner is offering “rent-to-own” as a possible financing option, they are taking on a high risk since in most cases, a rent-to-own buyer has a credit score that is not impeccable. Since an owner is taking a higher risk the terms for a rent-to-own must be considerably favorable for the owner. This often leads to less than favorable terms for a buyer. When looking at a rent-to-own as an option you can expect to provide a considerable amount of money down and a higher interest rate than what a lender is currently offering.

If you’re able to purchase a home by financing through a bank or lender, you will be better off because the terms will be more favorable.

Should I sell my current home before buying another?

There is truly no concrete “correct” answer to this question. There are pro’s and con’s to buying a home before selling your current home and the same can be said about selling your current home before buying another.

Buying a home before selling your current home

The biggest benefit to buying a home before selling your current home is the fact that you have a suitable property lined up. This can reduce the stress and pressure of having to find a home once your current home is sold. This however also can create disappointment and heartbreak. If you are unable to purchase a new home without having to sell your current home, you’re purchase offer is going to be contingent upon sale and transfer of title of your current home. If your current home does not sell in a timely manner, this can lead to you getting “bumped” by a non-contingent buyer and you losing out on the home you’re looking to purchase, which can be devastating.

Selling your current home before buying a new home

The time it takes to sell your current home is unpredictable. There is no crystal ball that exists that can tell you exactly how many days it will take. Selling your current home before buying a new home will put you in an ideal position to negotiate on the new home you’re purchasing due to the fact you are purchasing without the sale contingency of your current home.

One risk of selling your current home without buying a new home first is the chance of not being able to have a place to live. There are options if your current home sellers before buying another though. A “rent-back” can sometimes be negotiated with the buyer of your current home. A “rent-back” would allow you to retain possession of your current home for a certain number of days after closing at the expense of paying the buyers mortgage. A “rent-back” allows for additional time to find a new home.

How quickly can I close?

Typical escrow periods are 30 to 45 days. This gives you enough time to do the investigation on the property and get a loan completed, and yes, this due diligence counts.

How many homes should I see before making an offer?

For the most part, you want to see a number of homes so that you can become familiar with what you expect to get for your money. Some buyers find a home that “fits” after only a few trips and for some it just takes longer. It depends on the inventory at the time you are looking and also on your own wants and needs. When you do find a home that you really like, it’s a good idea to go back and look at it during a different time of the day. This will give you some better insight into what it will be like living in the home full time.

What should I think about when deciding which community to live in ?

It is important to understand what you have planned for your future. If you are raising (or planning on raising) a family then you may wish to find a community with a high percentage of new families with child friendly activity centers (municipal pools, parks, etc.). Every area has its own school district. If you have a specific school in mind then you will need to figure out which homes are within said district.

Whether you are planning to start a family or not, there are other factors which are just as important to consider. For many people, proximity to friends and family must be considered as well as the length of the commute to work. If you do not own a vehicle then you will also need to consider public transportation options.

Don’t forget about food. Traveling to a supermarket or a restaurant costs both time and money so having it close at hand will save you money in the long run.

When you talk with your real estate agent mention your future plans and they will factor those into your buying options.

What should I look for when walking through a home?

It is recommended that you have a home inspector examine the property but here are some tips on what to look for during your first time viewing a home.

Good foundations are extremely important in purchasing a home. If you have access to the basement then check the walls for cracks. Cracks in the foundation happen naturally as the house settles but you should look for vertical cracks and ones that are larger at one end than the other. Next when you are on the top floor check the doors and windows to see if they open and close easily. If a foundation has shifted then the top floor will have moved the most.

Water damage is very important to check. Inspect ceilings on every floor for discoloration or bubbles in paint. Check the basement for any discoloration in the concrete around cracks and look to see if you can find signs of mold and mildew. When outside the house look at the eaves as they are responsible from moving rain water away from the foundation.

Don’t forget to check every faucet, toilet and showerhead to see that the plumbing works well.

What is a short sale?

Before getting involved with a short-sale, it’s important you understand exactly what it is and what to expect from a short sale. The easiest way to understand a short sale is the sale of a home in which the proceeds from the sale are less than the balance of debts secured by liens against the property and the home owner cannot afford to pay the liens in full.

Before purchasing a short sale, you should consider things such as the time it can take for a short sale response, the fact that a foreclosure is still possible, and that many short sale properties are in disarray. Short sales are not impossible to buy but you must be patient and be in no immediate rush to move.

What is a foreclosure?

Believe it or not, foreclosures can actually be a smoother transaction than a short sale. A foreclosure, sometimes referred to as a REO, is a property that is owned by a lender. If you’re considering the purchase of a foreclosure, it’s important to understand that most are sold “as-is.” Foreclosures, if not purchased by an owner occupant, are often purchased by investors, fixed up, “flipped,” and sold to an owner occupant.

How much should I offer?

This is a question your agent will help you with as the answer is specific to the property. However, some factors that must be considered are:

Is the house in good condition?

Will you need to make renovations for it to suit your needs?

How long has it been on the market?

Is the asking price comparable to other similar homes in the area?

How do I know if the property is a good deal?

While there is no crystal ball on whether a certain home is a bargain and will appreciate, rest assured that with research, you can keep surprises to a minimum. The best way is to check out comparable sales — what similar properties are selling for in the area—“and whether those prices have been going up or down in the recent past.

What if my offer is rejected?

When a purchase offer is submitted to the seller there are generally four possible responses. The first is an accepted offer, the second is a counter offer, the third is a rejected offer, and the final is an offer that is not responded to. If your offer is rejected, meaning the seller says no and doesn’t counter, you have the right to place another offer. It’s not very common an offer is rejected or not responded to, unless a seller is offended by a low-ball offer.

When can I back out I change my mind?

While buyers can always back out of a deal, doing so without good reason may forfeit their earnest money (the cash put down to secure the offer, typically 1%-3% of the home’s price). But there are some ways to walk with your earnest money in hand.

Contingencies: For example, upon an unsatisfactory home inspection, the buyer can ask for their deposit back. Another contingency is ‘subject to appraisal’. That means you can back out if the lender for your loan doesn’t think the property is worth what you offered.

Home buyers aren’t the only ones with questions; home sellers have plenty on their minds, too. Find out what they are wondering in a new article next week!

Is a home Inspection necessary? What other inspection are needed?

Mortgage lenders will typically require an inspection for wood destroying insects. It is usually paid for by the buyer. A comprehensive home inspection is something that the buyer orders. They must be done within a specified period within the time frame of the agreement of sale parameters. It is not required which is why the buyer pays for it but it is a wise thing to do. We highly recommend that, at the time of the inspection, you accompany the inspector as he/she does their inspection. This is important so you can learn firsthand as much as possible about the home you are about to purchase-including such basics as where the main water shut-off and electrical distribution boxes are. Is a home inspection worth the price? Consider this. Home inspections cost between $200 and $400. Weigh that against the comfort of moving into a known situation, and the answer is obvious … get a home inspection!

What’s the age of the house?

When looking at homes, many buyers want to know the ages of specific items in a home. The most popular items in a home that buyers want to know about are the major mechanical items, such as the roof, furnace, water heater, and air conditioning (if applicable). An experienced Realtor should be able to find the dates of a furnace, water heater, and air conditioning unit by looking at the serial numbers. The roof age is often known by the home owner. If not, the age usually can be approximately determined by looking at the roof characteristics, such as the sagging areas and the way the shingles are laying.

What are home warranties?

Not to be confused with homeowners insurance which covers perilous damage like fire and property crimes, home warranties cover components in the home. The contract will disclose exactly what the home warranty company will cover but often the company provides discounted repair or replacement on things like furnaces, HVAC systems, electrical systems and plumbing systems.

What’s the next step?

Congratulations! Your offer was accepted, now what? Between contract acceptance and the closing date, there are many things that need to be completed. In a nutshell, after an offer is accepted, generally any inspections will be completed. After the inspections, you complete a formal mortgage application and last but not least, the title, abstract, survey, and any miscellaneous paperwork is completed. When buying a home, finding the perfect home is only one part of actually becoming a homeowner. Throughout the mortgage process, you should expect the bank to require documentation, letters, and other items from you to satisfy the bank conditions, so don’t be upset or surprised when this happens.

What is title insurance and why do I need it?

Title insurance assures that you have clear title to the home you are purchasing. It’s very important and the primary component of “due diligence”. The title search determines whether the seller actually owns the property and if there are any claims against it. In most cases, the buyer pays for the insurance. We work with a number of very good title companies or you can choose to use your own. In any case, the title search is ordered shortly after an agreement of sale is reached and then paid for at settlement. The price is state mandated.

How about some advice on Homeowners Insurance?

A standard homeowner’s policy protects against fire, lightening, wind, storms, hail, explosions, riots, aircraft wrecks, vehicle crashes, smoke, vandalism, theft, breaking glass, falling objects, weight of snow or sleet, collapsing buildings, freezing of plumbing fixtures, electrical damage and water damage from plumbing, heating or air conditioning systems. Such policies are called “all risk” policies, which cover everything except earthquakes, floods, war and nuclear accidents. A basic policy can be expanded to include additional coverage, such as for floods and earthquakes and even workers’ compensation for servants or contractors. Home-based business-coverage, an increasingly popular rider, does not cover liability associated with the business. Insurance experts recommend that homeowners obtain insurance equal to the full replacement value of the home. On a 2,000 square foot home, for example, if the replacement cost is $80 per square foot, the house should be insured for at least $160,000.

Do I need to do a final Walk-through?

As a buyer, you have the option to perform a final walk-through. Is a final walk through a requirement? NO. Is a final walk through necessary? YES. Generally when buying a home several weeks go by between when you last walked through your home. Lots of things can change during that time. When doing a final walk through a few things you should check is that furnace is working, the toilets are flushing properly, and there is hot water.

When is the closing date?

When buying a home, the excitement level is extremely high. It’s important to understand that the closing date in the purchase offer is a target and not a guarantee. Before you hire the movers and take time off from work, know that the closing date in the contract isn’t necessarily the date you will own your new home. Many buyers will ask their Realtor this question, however, it isn’t up to the Realtors when a closing will be. The attorney’s are the ones who have to set the closing date and time.

When do I get the Keys?

The short answer is “At Closing”. Under normal circumstances, you will get the keys at the closing. A closing typically takes about an hour. In some cases, the lender will need time to fund the loan and you will need to pick up the keys after the loan has been funded. If you have a Friday evening closing and the loan cannot fund until Monday, you may not get the keys until Monday. Make sure to coordinate your closing to get the keys on the same day, if that is what you need.

Get In Touch

Phone Number:

604-908-9697

Email: [email protected]

Royal Lepage Global Force Realty

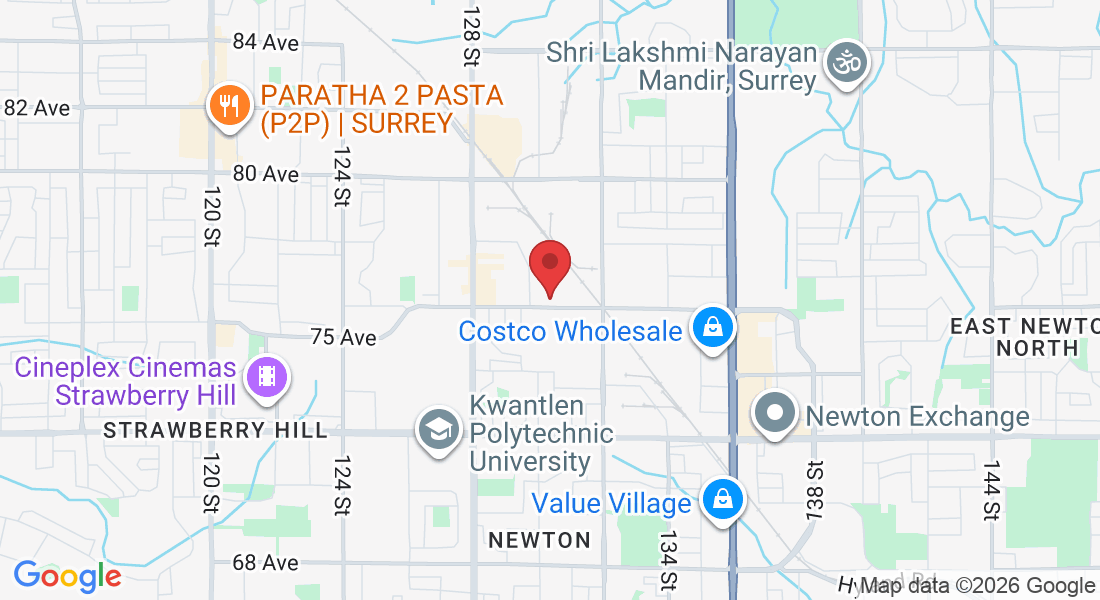

Surrey Office: 15300 54a Ave #306, Surrey, BC V3S 8R7

Abbotsford Office: 33555 South Fraser Way, Abbotsford, BC V2S 2B7

Assistance Hours

Mon – Sun 9:00am – 8:00pm

Good Deal Real Estate.

Your Local Expert, the Obvious Choice.

© 2024 Kevin Singh Gill Personal Real Estate Corporation - All Rights Reserved. Contents of this website, including the photography & videos, may not be used without written consent. Maximum effort is put towards the details but cannot guarantee, buyer to verify all details. https://kevinsinghgill.ca/terms-and-conditions ,https://kevinsinghgill.ca/privacy-policy

Facebook

Instagram

Youtube

TikTok